How to Use a Digital Budget Planner to Take Control of Your Money

Why a Digital Budget Planner Changes Everything

Budgeting doesn’t have to be complicated or restrictive - it’s simply a way to give your money direction. When you can see where every pound (or dollar) is going, you can make smarter choices without guilt or guesswork.

A digital budget planner makes this process easier, cleaner, and more flexible than paper budgeting. You can duplicate pages, update numbers on the go, and instantly see your progress, all in one place.

If you’ve ever wondered where to start, here’s a step-by-step guide to using your digital planner to take full control of your money this year.

Step 1: Get the Full Picture of Your Finances

Before creating a budget, you need a clear view of what’s already happening with your money. This is where your “My Finances” section comes in.

Use the templates for:

Bank Accounts → list all your active accounts in one place.

Credit Cards → track balances, due dates, and interest rates.

Debt Accounts → record remaining balances and payment history.

Savings Accounts → keep an overview of where your money’s growing.

💡 Tip: Add approximate totals to each section so you can quickly see your financial landscape. Awareness is the first step to control.

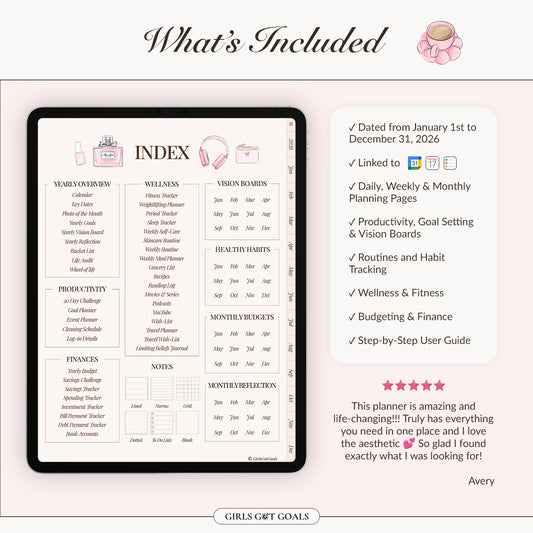

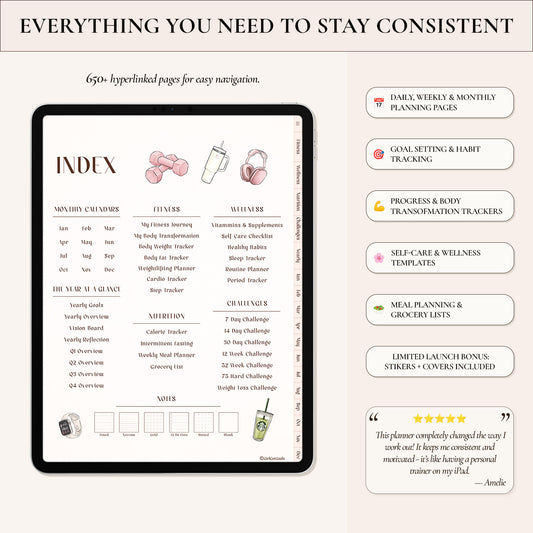

Step 2: Create Your Monthly Budget

Once you know what’s coming in and going out, it’s time to plan your month intentionally.

Start each month with the Monthly Budget and Monthly Overview templates.

Here’s how they work together:

Monthly Budget: Plan your income, expenses, and savings goals for the month.

Monthly Overview: Reflect on results at month’s end - what went as planned, what didn’t, and where you can adjust.

Pair these with your Calendar or Bill Tracker pages to see important payment dates and deadlines at a glance.

💡 Tip: Budgeting monthly keeps things flexible. You can adapt as your income or priorities shift, without losing track of your bigger goals.

Step 3: Track Spending and Bills

This is where most people fall off - tracking. But your digital planner makes it simple.

The Spending Trackers and Bill Trackers help you stay on top of day-to-day transactions and recurring expenses. You can use them to:

Record daily purchases (and spot spending patterns).

Track subscriptions and memberships.

Log bills with due dates and mark them paid.

💡 Tip: Color-code or highlight categories (e.g., food, travel, self-care) to spot where most of your money goes. Awareness builds accountability.

Step 4: Build a Personalized Savings System

Once your essentials are organized, it’s time to grow your savings - and make it fun.

The planner’s Saving Challenges section gives you multiple ways to save intentionally:

52 Week Challenge → small weekly deposits that add up over time.

Cash Envelope Challenge → digital version of the classic budgeting method.

Goal-Based Trackers → for milestones like Christmas, vacations, or weddings.

If you’re working toward something specific, the Savings Trackers help you stay motivated - seeing progress visually is incredibly satisfying.

💡 Tip: Name your savings goals: “Paris Trip,” “New Laptop,” or “Emergency Fund”, so they feel personal and motivating.

Step 5: Manage Income & Expenses in Detail

To keep everything accurate, use the Finance Trackers section to monitor how money flows each month.

You’ll find templates for:

Income Tracker → record multiple income sources.

Paycheck Budget → divide your paycheck into expenses, savings, and fun money.

Expenses Breakdown → see where your money’s going in clear categories.

These pages help you analyze spending patterns and make small changes that add up to big results.

💡 Tip: Review your expense breakdown at the end of each month, noticing where small leaks happen can save you hundreds over time.

Step 6: Plan for the Long Term

Short-term budgets are helpful, but long-term planning is what builds financial freedom.

Use your Financial Vision Board to outline your big-picture goals - maybe becoming debt-free, growing your savings, or investing. Then use the Financial Goal Planner to set actionable steps for each one.

For deeper tracking, explore the Investment Tracker, Debt Payment Tracker, and Retirement Funds templates. Each one keeps your future finances organized and visible.

💡 Tip: Set quarterly “finance check-ins” using the Quarterly Overview Pages to reflect and realign your goals.

Step 7: Stay Consistent with Reflection & Routine

Budgeting isn’t about perfection, it’s about consistency.

At the end of each month, use your Monthly Overview to note what worked and what you’d like to adjust. Maybe you overspent in one category but saved more than expected in another — that’s still progress.

Your Notes and To-Do List pages can also double as a financial journal — record wins, challenges, or ideas for next month.

💡 Tip: Treat money check-ins like self-care. Make a cup of coffee, put on music, and spend 15 minutes reviewing your planner - it turns finances into something empowering instead of stressful.

Take Control of Your Finances — One Template at a Time

Getting organized with money isn’t about restriction, it’s about freedom.

When you have clarity on where your money’s going, you can make choices that support your goals instead of stressing you out.

The Digital Budget Planner is designed to make that process simple, visual, and motivating - everything you need to build better habits and feel confident about your finances.

👉 Explore the Digital Budget Planner

Start creating your financial freedom today - one page, one paycheck, one goal at a time.